Subscribe for real-time financial insights on Trade Target’s WhatsApp Channels

Imagine a place where speed meets flavor, meals are quick and satisfying. Whether you want to enjoy a cheesy pizza from Domino’s after finishing your hectic day or a mouthwatering burger from McDonald’s to celebrate your girlfriend’s birthday, even you want to enjoy crispy chicken from KFC after watching a nail-biting India vs. Pakistan World Cup match. India’s Quick Service Restaurants (QSRs) are always there to serve you promptly, and these places are not only easily accessible but also widely popular. These locations are not just eateries, these are like a burst of flavor in every bite. QSRs are like food superheroes who always serve you when you need them.

In this blog, we will take you on a tasty journey through the world of QSRs, we will introduce you to some of the big players in India’s Quick Service Restaurants industry and explore how profitable these companies are. Whether you are a foodie, celebrating a special day, or simply up for some good eats, come along for a delicious ride!

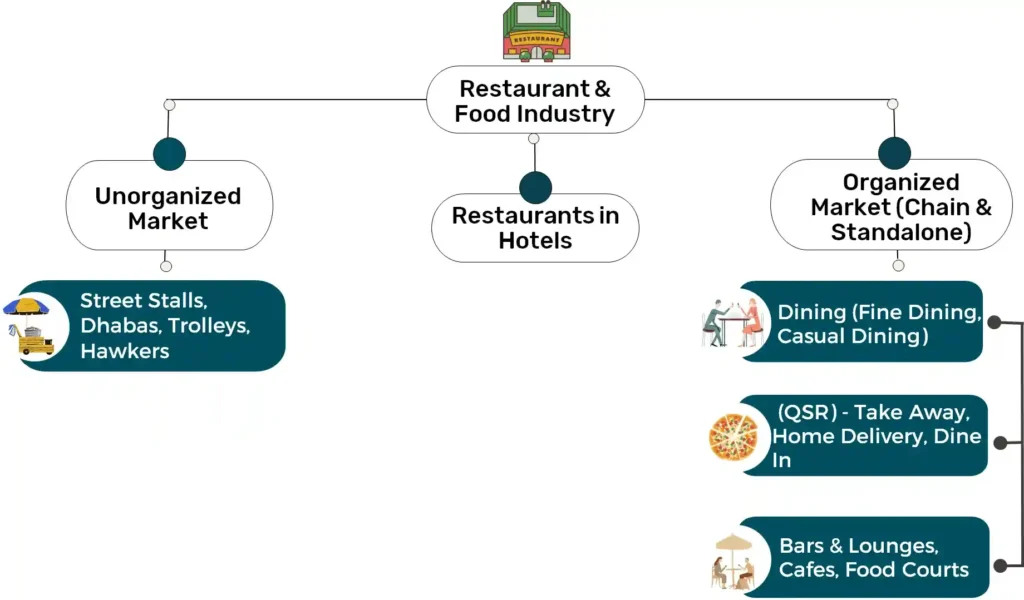

Classification of Food Service Sector: Organized vs. Unorganized

Before we dive into Quick Service Restaurants (QSRs), let’s understand QSRs and its types: organized and unorganized.

The Organized category includes restaurants and food outlets that operate with clear rules and transparency in accounting and have a wide presence in various locations. These can be further divided into two types: chains (restaurants with more than three outlets across the country) and standalone outlets.

In contrast, the unorganized category includes dhabas, street stalls, trolleys, and hawkers, which may not have as many rules and regulations governing their operations.

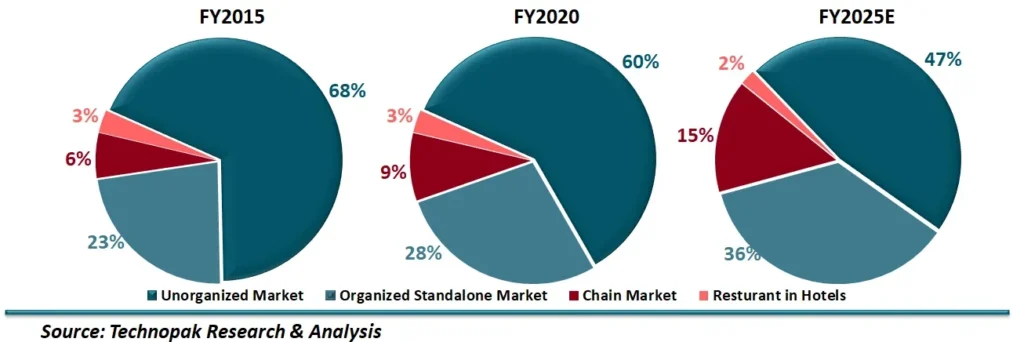

Rise of Organized Food Services, Decline in Unorganized

In recent years, a notable trend shifted towards organized food services, with market share data reflecting this transition. As of FY 2015, the unorganized market held the largest share at 68.1%, which decreased to 59.5% by FY 2020 and is projected to further decline to 47.3% by FY 2025. Meanwhile, the organized standalone and chain markets have been steadily gaining ground, highlighting the evolution of India’s food service sector.

India’s Quick Service Restaurants Industry Recap

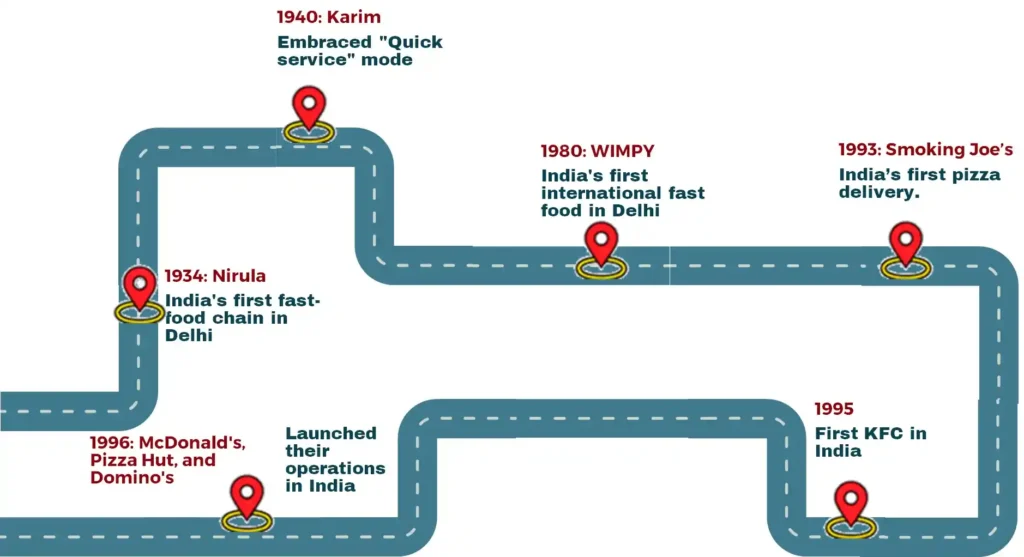

The fast-food industry in India has an interesting history. It started in 1934 when Nirula’s opened India’s first-ever fast-food chain in Delhi. Around the 1940s, local restaurants like Karim’s also adopted a quick-service approach. Fast forward to the 1980s, when things really took off. In 1980, WIMPY, India’s first international fast food outlet, opened its doors in Delhi. Then, in 1993, Smoking Joe’s became the first pizzeria in India to offer home delivery. But the big wave came in 1995 when KFC opened its first restaurant in India, followed by McDonald’s, Pizza Hut, and Domino’s in 1996.

These international brands completely changed the food scene in India, which was previously dominated by local names like Haldiram’s, Nirula’s, Honest, and Sarvana Bhavan.

It brought more choices to consumers and created opportunities for chefs and small restaurant owners to showcase their talents.

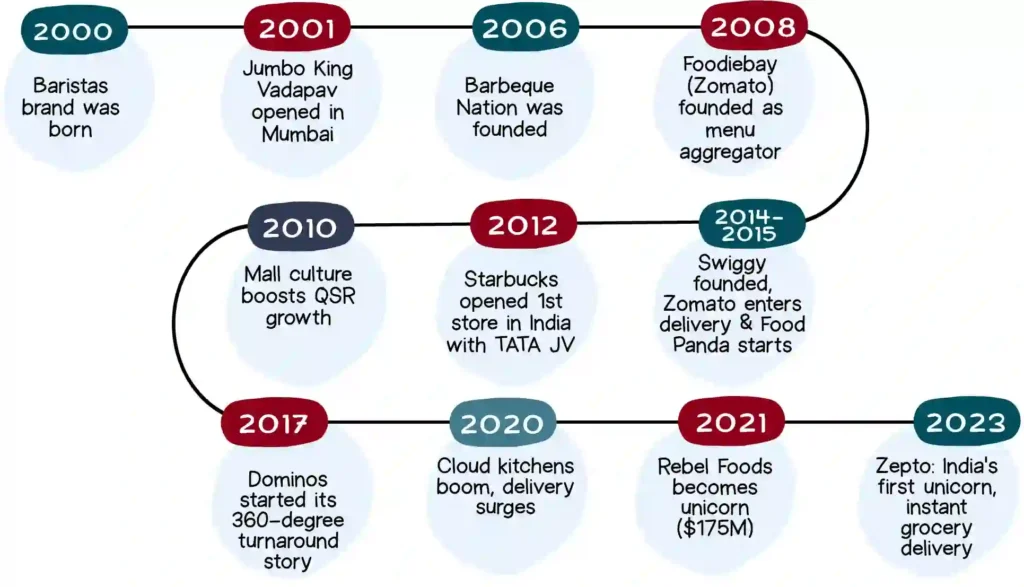

Since year 2000, the Indian food services industry has gone through several changes. Today, it continues to adapt and innovate, reflecting the ever-changing nature of India’s food services landscape. Let’s explore this journey.

- Phase I (2001-2010): During this period, different types of food service formats like Quick Service Restaurants (QSRs), Casual Dining Restaurants (CDRs), and Fine Dining Restaurants (FDRs) started taking shape. In phase one, the focus was mainly on major cities and metropolitan areas. And franchise models were quite popular, and businesses were exploring partnerships and joint ventures.

- Phase II (2010-2016): In this phase, the food industry changed to meet customer preferences by offering different pricing options and expanding its reach to smaller cities. And we started seeing more food ventures funded by private equity investments.

- Phase III (2016 Onwards): In phase three, we saw a rapid growth of food aggregators and cloud kitchens. Tier II cities experienced a lot of growth in the food industry, while Tier I cities had so many food options that there was little room for more. During this time, established food brands expanded, and new and creative food ideas became popular.

Now, let’s have a look at QSR’s journey after 2000, highlighting the industry’s ability to adapt and thrive in India’s ever-changing food services landscape.

India’s Quick Service Restaurants After 2020

Post 2020, the Quick Service Restaurant (QSR) industry in India has shown a positive trend driven by technological advancements. Notably, improved Point of Sale (POS) systems, diverse payment options, and enhanced geolocation services have contributed to the food delivery segment.

In the past five years, over 20 Indian-origin QSR brands have expanded, with 75-100 or more stores throughout India. The restaurant industry faced its toughest challenge during the pandemic and subsequent lockdowns, causing many restaurants to shut down.

Surprisingly, even in the face of the COVID-19 pandemic, Quick Service Restaurants (QSRs) managed to not only survive but thrive. These QSRs quickly adapted to the changing situation.

To ensure the safety of their customers in a post-lockdown, a restaurant made changes in its policy, like stopping direct delivery orders through their platforms and partnered with popular delivery services like Swiggy and Zomato. This shift allowed restaurants to provide contactless delivery while strictly following all safety protocols.

Presently, there are 490 QSR brands in India, out of these, 428 are open and serving. Surprisingly, 10 of these brands have more than 100 stores each, and five of them have over 150! This industry has seen a lot of investment, with different brands raising about $1.3 billion Market Value of the Indian Food Service Industry.

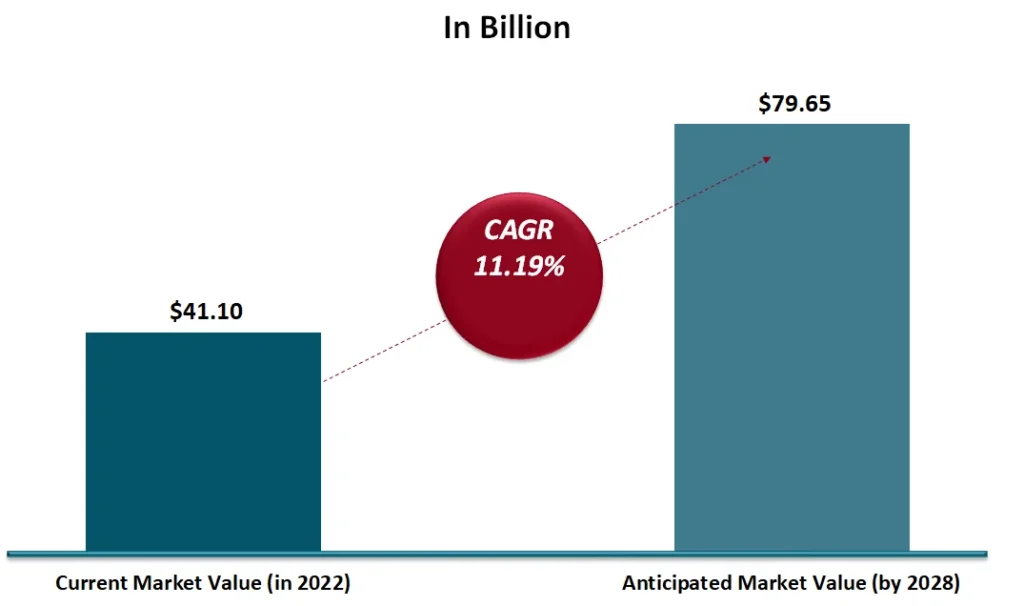

As of 2022, the food service market in India was valued at USD 41.1 billion. Forecasts suggest it will sustain a Compound Annual Growth Rate (CAGR) of 11.19% and reach a valuation of USD 79.65 billion by 2028.

In our journey through India’s Quick Service Restaurant (QSR) industry, we’ve seen how this industry has grown and adapted over the years. So, keep reading this blog, as there’s still so much more to discover.

Key Players in the India’s Quick Service Restaurants Industry

The Indian fast-food industry has both local and international giants. In the chain segment, some well-known players include Jubilant FoodWorks (which owns Domino’s Pizza, Dunkin’ Donuts, and Popeyes), Westlife Development (the company behind McDonald’s), Burger King India Limited, Burman Hospitality (managing Taco Bell in India), and famous names like KFC, Pizza Hut, Subway, Cafe Coffee Day, Barista, Haldiram’s, and Adyar Ananda Bhavan.

Apart from these, there are many standalone restaurants spread across different states in India that we all know and love.

Market Share of Key Players from the India’s Quick Service Restaurants Industry

A large part of Indian quick-service restaurants (QSRs) is still untapped, which can work as an opportunity for international QSR companies. These companies have traditionally focused on the major cities, known as Tier I cities. However, in recent years, they’ve expanded their presence into Tier II and Tier III cities as well, and the location of these QSR outlets is primarily determined by factors such as the local population, people’s income levels, and how easily people can reach these places.

Here’s a chart that shows the market share of key QSR players in 2020, both in terms of revenue and the number of outlets they have.

Market Share By Outlet Count (FY20)

No Data Found

Market Share By Outlet Revenue (FY20)

No Data Found

Source: Technopak Research & Analysis

Listed Quick Service Restaurants Stocks in India

Here is a list of Quick Service Restaurant (QSR) stocks in India, along with their debut dates on the stock market, the initial price range they offered, and their current stock prices.

Your favorite QSR brands are now listed on the stock market, and these brands are setting the stage for a promising future. Companies like Jubilant Foodworks, Devyani International, Sapphire Foods India, and more have demonstrated their resilience and adaptability to meet evolving consumer demands.

As of September 15, 2023, these companies’ stock prices vary, reflecting a diverse range of performances within the industry. Despite the challenges the QSR sector faces, it continues to grow, driven by its flexibility and commitment to expanding its reach. The evolving preferences of consumers for quick, high-quality dining experiences are fueling this growth, making the QSR industry an exciting space to watch. It appeals to both investors and those who appreciate the world of food and dining.

Please note that the status and stock prices of these companies may have changed since my last update in September 2021. It is advisable to verify the latest data for the most current information.

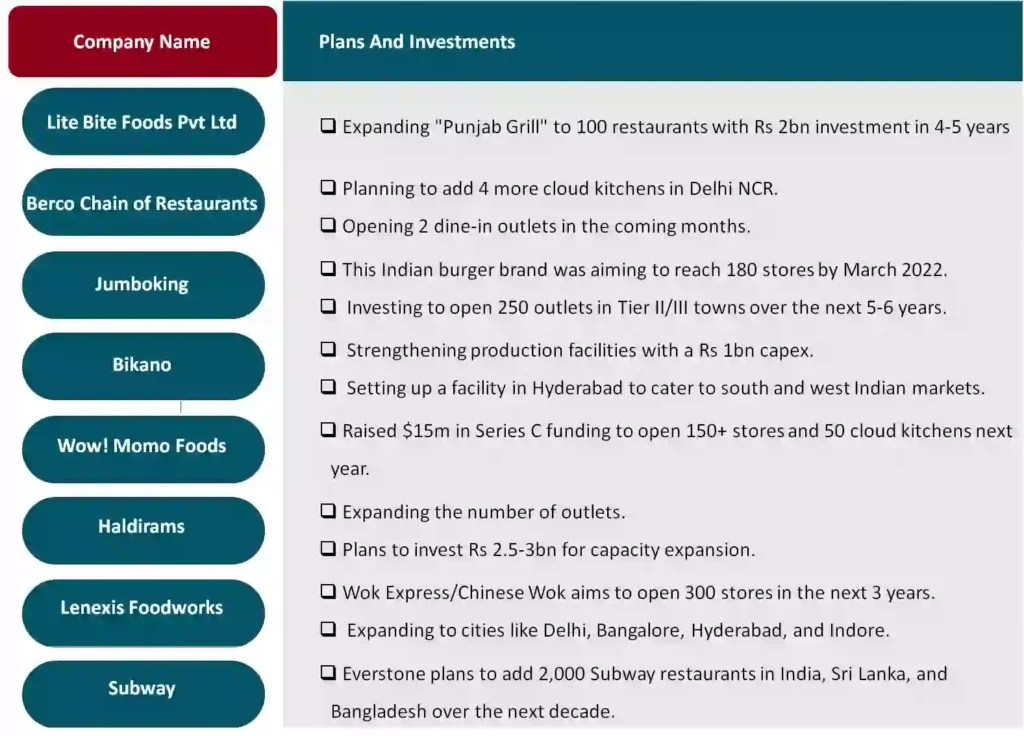

Unlisted QSR Companies in Expansion Mode

The Quick Service Restaurant (QSR) industry in India is booming, with many smaller, unlisted companies looking to expand and invest in the near future. Established players like Lite Bite Foods Pvt Ltd, Berco Chain of Restaurants, Jumboking, Bikano, Wow! Momo Foods, Haldirams, Lenexis Foodworks, and Subway are not only expanding their presence but also diversifying their menu offerings to cater to a broader range of customers and locations.

The QSR industry’s growth is driven by innovative strategies, investments, and the growing demand for various food options in India and nearby regions. Newer QSR businesses like Burger Singh, Drunken Monkey, Chai Point, Goli Vada Pav, Barista, and others highlight the opportunities to establish themselves and further contribute to the industry’s success.

India’s Quick Service Restaurants: Growth, Challenges, and Future Prospects

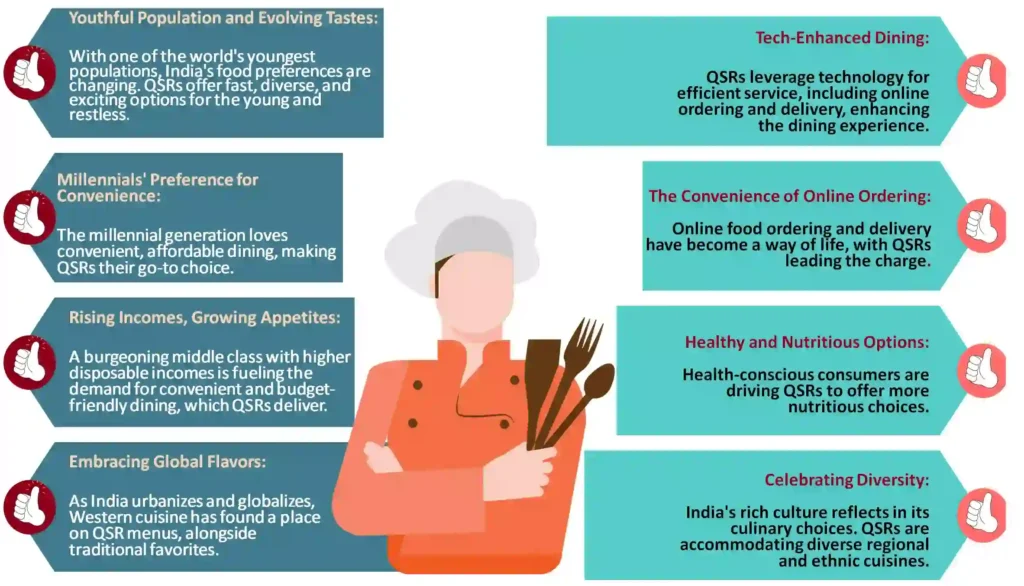

The Quick Service Restaurant (QSR) industry in India is on the verge of an exciting and diverse future. With a young and ever-changing population, a strong desire for convenient and varied dining experiences, and a growing middle class, the QSR industry is set for impressive growth. From serving the needs of busy millennials to embracing global flavors and technology-driven convenience, QSRs have become an integral part of modern India. As our tastes shift towards healthier options and a celebration of regional and ethnic cuisines, the QSR industry is not just keeping pace it’s leading the way toward a flavorful, innovative, and dynamic future.

Even though the QSR industry in India is doing well, it faces some big challenges and risks. Let’s discuss what these restaurants are facing and how they are addressing these issues.

- Competition: Indian QSRs face intense competition from both local and international brands. They are staying ahead by innovating and adapting to changing tastes.

- Food Safety: Food safety is a top priority for QSR chains in India. Ensuring that the food is safe and hygienic is non-negotiable. These companies have implemented rigorous quality control measures, stringent hygiene protocols, and regular audits to guarantee that every meal served is both delicious and safe.

- Rising Costs: The cost of ingredients keeps rising, particularly during the pandemic. To address this, restaurants adjust menus and add items with better profit margins.

- Economic Slowdown: Economic slowdowns can lead to less spending. To address this, they are offering numerous deals and promotions.

- High Real Estate Prices: Real estate is one of the highest cost components for food service companies and further spikes could slow restaurant growth.

- Changing Preferences: Changing demographics and increased awareness of health have led to a higher preference for non-junk or home-cooked food, so the QSRs industry is responding with better menu options.

- Labor Costs: Attracting and retaining skilled staff is tough, especially in an industry known for instability. Automation is emerging as a solution, and global food chains like Subway are adopting technology, such as vending formats where customers can place their orders and receive their meals or snacks without direct interaction with human staff.

- Supply Chain Disruptions: Last but not least, supply chain disruptions have caused food shortages and price hikes. QSRs are finding new suppliers and improving their resilience against future disruptions.

As we come to the end of our exploration into India’s dynamic QSR industry, we’re interested in hearing your perspective. What’s your take on this exciting journey? Do you see Quick Service Restaurants as a hub of innovation and opportunity, or have you encountered challenges and experiences that shape your view differently?

Share your thoughts and expectations for the future of India’s QSR industry. In this culinary adventure, every viewpoint adds a unique flavor to the mix.

Happy investing and thank you for reading!

Disclaimer:

This website content is only for educational purposes, not investment advice. Before making any investment, it’s important to do your own research and be fully informed. Investing in the stock market includes risks, and you should carefully read the Risk Disclosure documents before proceeding. Please remember that past performance doesn’t guarantee future results, and due to market fluctuations, your investment goals may not always be achieved.

Share via: