Subscribe for real-time financial insights on Trade Target’s WhatsApp Channels

Ah, Top 10 Penny stocks – the very mention of words that generally arouse excitement and caution among investors. To some it represents an opportunity to strike it rich quickly, while to others, they sound alarms of potential risks and losses. These low priced, high volatility stocks have a unique attraction, regularly promising massive returns in a short span of time. However they also carry a major degree of uncertainty and are notorious for their susceptibility to manipulation and sudden price swings.

So buckle up, guys, we will be shedding light on the myths and truths behind this exciting investment opportunity with top 10 penny stocks for you.

What is Penny Stocks?

Penny stocks are stocks traded at very low prices, often below ₹50 in India and usually belong to companies with a market capitalization of less than ₹10 crores. These stocks are listed on exchanges like NSE and BSE. They are called penny stocks because they trade at such low prices, sometimes as low as ₹0.01. While they can offer high returns if they hit upper circuits for consecutive days, they also come with risks. They are regularly illiquid, meaning there is not much trading activity which can lead to major price fluctuations with just a few orders.

Sometimes, penny stocks surge due to strong fundamentals but other times they are manipulated by operators who exaggeratedly inflate prices to attract unsuspecting investors before offloading their own shares. Despite the potential for big gains, many investors avoid penny stocks due to the lack of reliable information about their businesses and the higher risk of price manipulation. However, some penny stocks have transformed into multi baggers, delivering returns far exceeding their initial cost which makes them intriguing for some investors willing to take on the added risk.

If you are new to investing in stocks, it is important to conduct thorough research before diving into penny stocks in 2024. Now that we have grasped how penny stocks operate, let’s explore why they are called “Penny” Stocks.

Why Are Penny Stocks Called Penny Stocks?

Penny stocks are called penny stocks because they trade at very low prices and many traders buy them hoping for quick profits and then sell them off. These stocks generally don’t meet exchange regulations and lack transparency in reporting. They only gain attention when there is news or a turnaround story, leading to speculation and price surges. However, most lack strong fundamentals, and any negative news can cause prices to drop quickly.

With a clear understanding of penny stocks and their nuances, we are now ready to discuss the top 10 penny stocks by market cap.

Top 10 Penny Stocks to Watch in 2024

- Vikas Ecotech Ltd

Vikas Ecotech is specialized in high end specialty chemicals. They offer a wide range of eco-friendly rubber plastic compounds and additives critical for manufacturing top tier products across sectors like agriculture, automotive, healthcare etc. In short, they are a go to for superior quality, environmentally conscious chemical solutions.

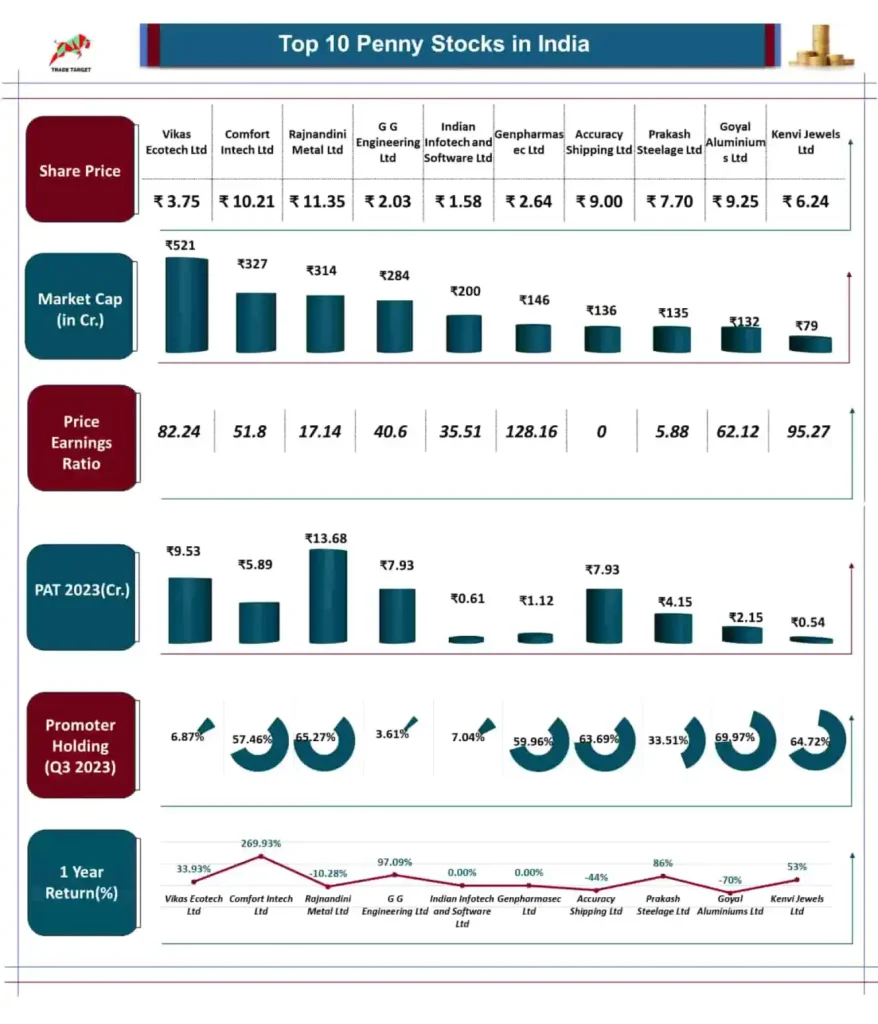

It has a share price of ₹3.75 and a market cap of ₹521 crore. Its price earnings ratio is 82.24, and its promoter holding as of Q3 2023 is 6.87%. The company has seen a 1 year return of 33.93%.

- Comfort Intech Ltd

Established in 1994, Comfort Intech Ltd is involved in range of business activities, from trading various goods and services to producing liquor. As a Comfort Group member, CIL trades items like fans, fabrics, water heaters, and mono-block pumps through online platforms, serving as direct suppliers to marketplace platforms. Additionally, the company manufactures and sells spirits, offering a variety of products like India Made Foreign, Country and Beverage spirits.

It has share price of ₹10.21, with a market cap of ₹327 crore. It has a price earnings ratio of 51.8 and a promoter holding of 57.46%. The company has shown a significant 1year return of 269.93%.

- Rajnandini Metal Ltd

Established in 2010, Rajnandini Metal Ltd produces, trades, and supplies top-quality Copper Continuous Casting Rods and copper wires. Initially, the company primarily traded in various types of scrap metals including ferrous and non-ferrous materials like Copper Wires, ingot scrap, and similar items utilized in different electrical and industrial settings. However, starting from 2019 the company shifted its focus towards manufacturing Copper Rods, Wires and other products offering diverse range of grades, thicknesses, widths and standards tailored to meet the specific requirements of customers.

It has a share price of ₹11.35 and a market cap of ₹314 crore. Its price earnings ratio stands at 17.14, with a promoter holding of 65.27%. The company’s 1year return is -10.28%.

- G G Engineering Ltd

Established back in 2006, G G Engineering Ltd is involved in the trading of iron and steel metals. Based out of Ghaziabad the company deals in various products and services, including structural steel, agricultural pipes, tor steel, and MS pipes.

It has share price of ₹2.03, and its market cap is ₹284 crore. It has a price earnings ratio of 40.6 and a promoter holding of 3.61%. The company has shown a 1year return of 97.09%.

- Indian Infotech and Software Ltd

Established back in 1982, Indian Infotech and Software Ltd specializes in offering loans and engaging in share trading. The company extends business loans to both individuals and businesses. Additionally, IISL buys and sells shares of various companies. It’s worth noting that IISL is categorized as a Non-Systemically Important Non Deposit Taking Non Banking Financial Company.

It has a share price of ₹1.58 and a market cap of ₹200 crore. Its price earnings ratio is 35.51, with a promoter holding of 7.04%. Other details like the 1year return are not provided.

- Genpharmasec Ltd

Established in 1992, Generic Pharmasec Ltd is involved in pharmaceutical operations and also engages in trading equity shares. Initially, GPL operated as a producer and trader of various chemicals, dyes, and pigments. Over time, the company transitioned its focus to the buying, selling and distribution of pharmaceutical products, medicines and preparations. Additionally, it expanded its business to include participation in the securities market. Presently, the company is primarily involved in dealing with medical and diagnostic devices.

It has share price of ₹2.64 with a market cap of ₹146 crore. It has a high price earnings ratio of 128.16 and a promoter holding of 59.96%. Other details like the 1year return are not provided.

- Accuracy Shipping Ltd

Accuracy Shipping Ltd specializes in offering tailored third-party logistics solutions. They provide a wide range of services including transportation distribution, freight forwarding, customs clearance, warehousing and additional value added services.

It has share price of ₹9.00 with a market cap of ₹136 crore. The company’s price earnings ratio is not provided. It has a 1year return of -43.75%.

- Prakash Steelage Ltd

Established in 1996, Prakash Steelage Ltd specializes in the manufacturing and exporting of stainless steel tubes and pipes. Initially a trader of stainless steel sheets, coils, plates and scrap, the company now specializes in producing seamless and welded stainless steel pipes and tubes while also trading in related products from its base in Silvassa.

It has share price of ₹7.70, and its market cap is ₹135 crore. It has a price earnings ratio of 5.88 and a 1year return of 85.71%.

- Goyal Aluminiums Ltd

Goyal Aluminiums is a top notch company that specializes in crafting aluminum coils, sheets, sections and various other aluminum components. GAL is involved in trading, manufacturing, and wholesale distribution of these products. Additionally, it engages in the mining, alumina, and aluminum sectors with further diversification into minerals, metals, and energy industries.

It has share price of ₹9.25, with a market cap of ₹132 crore. Its price earnings ratio is 62.12, and it has a 1year return of -69.52%.

- Kenvi Jewels Ltd

Established in 2002, Kenvi Jewels trades in precious metals and jewelry. They design and manufacture our jewelry in-house, occasionally collaborating with external designers. Their collection includes gold jewelry with or without diamonds and other gemstones.

It has share price of ₹6.24, and its market cap is ₹79 crore. It has a price earnings ratio of 95.27 and a 1year return of 53.32%.

Share via:

- By Hemant

- No Comments

- 16