Subscribe for real-time financial insights on Trade Target’s WhatsApp Channels

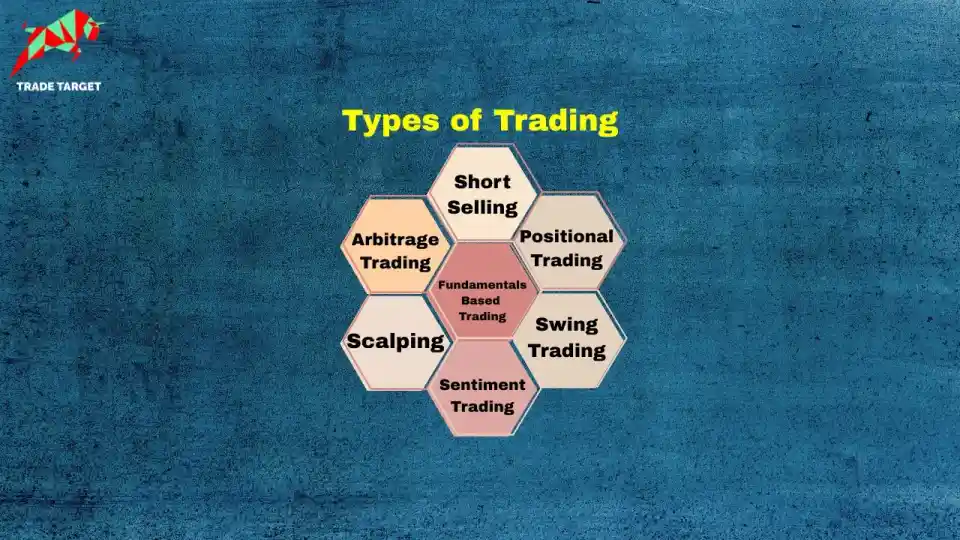

Traders enter the stock market with one goal, to make a profit, but the way they trade varies based on different types of trading strategy, time horizon and risk appetite. Some prefer quick trades that last minutes or hours, which is intraday trading. Others hold stocks for days or weeks to capture price swings, known as swing trading. There are also long term traders who wait months or years based on detailed analysis, so there are different types of trading in stock market.

Each trading type, whether intraday, swing or positional comes with its own method, risk level and profit potential. Understanding the different types of trading in stock market, helps you pick the right trading style for your personality and financial goals.

Let’s explore different types of stock trading strategies along with their holding periods, analysis methods and risk profiles, starting with one of the most commonly misunderstood tactics:

Different Types of Stock Trading

Here are different types of trades.

Short selling is a trading strategy in stock market, where traders initiate a trade on a stock’s price falling. Traders sell first and buy later. This might sound odd, but here’s how it works, if you believe a stock will drop, you sell it now even if you don’t own it and buy it back later at a lower price, making a profit from the difference.

- In cash market, short selling must be done only on an intraday basis, meaning the trade has to be squared off before the market closes.

- However, in the futures market, short positions can be carried forward to the next day.

Swing trading involves holding stocks for a few days, between 2 to 10 days. Traders look for short term price movements and trade based on patterns, trends or momentum signals.

Swing traders use:

- Technical indicators like moving averages, head and shoulders, flags and triangles

- Momentum triggers such as 52 week highs or lows

- A mix of technical and fundamental analysis

Swing traders trade in both rising and falling markets by buying long in an uptrend and going short in a downtrend. Compared to intraday trading, swing trading allows more time to analyze and make decisions.

In fundamental trading, buying and selling decisions are based on a company’s financial health, not just the price movement.

For this types of trades traders look at:

- Earnings per share (EPS)

- Revenue growth

- Cash flow

- News such as earnings announcements, analyst ratings and peer analysis, etc.

These events cause sharp price movements, offering quick opportunities, but timing is important, as this information spreads fast.

Positional traders invest based on a long term trend and are willing to hold a stock for weeks to months, sometimes even longer.

- Traders buy based on fundamentals and decide when to sell based on technical indicators, such as 200 day moving average.

- This approach works best in a bull market, where stocks are generally rising.

- It requires patience as profits are expected over time not immediately.

Sentiment traders make their decisions on overall market mood, whether investors are feeling bullish or bearish.

- Rising prices signal positive sentiment

- Falling prices signal negative sentiment

Traders closely follow market news, expert opinions and sometimes even use quantitative analysis tools to scan thousands of data points and headlines to understand sentiment trends.

Arbitrage trading is about exploiting price differences of the same stock in two markets, such as NSE and BSE.

Example: If a stock trades at ₹100 on NSE and ₹101 on BSE, you can buy it on NSE and sell on BSE to make ₹1 profit.

- However, this works only if you already hold the stock in your demat account, you can't buy on one exchange and sell on the other instantly.

- Arbitrage also exists between cash and futures markets, where price gaps can be used to make gains.

- Large institutional players use automated systems to detect and act on these opportunities quickly.

Scalping is a fast paced intraday trading strategy. Traders enter and exit trades within seconds to minutes, targeting small profits from each move.

- Since trades are short, risk is lower

- Small price movements like ₹100 to ₹101 happen more frequently than big ones

- Scalping requires quick decision making, fast execution and a strong understanding of market behavior

This types of trading demands focus, speed and discipline.

Intraday trading, one of the most popular types of trading in the stock market, involves buying and selling stocks on the same day. Traders aim to profit from short-term price movements and usually close all positions before the market closes to avoid overnight risks.

It requires quick decision-making, technical analysis, and discipline to identify opportunities for fast gains.

Momentum trading is one of the types of trading in stock market, where traders buy stocks showing strong upward trends and sell those showing downward trends. It focuses on price movement rather than company fundamentals. Traders often use tools like moving averages, RSI, and other indicators to identify opportunities and profit from ongoing trends.

Why Risk Management Matters in Different Types of Trading

In all types of trading, managing risk is essential to protect your capital and achieve long-term success. It helps you:

- Preserve Capital: Minimizes losses and protects your funds.

- Reduce Emotional Stress: Predefined limits prevent fear- or greed-driven decisions.

- Ensure Long-Term Profitability: Consistent risk control supports sustainable returns.

Essential Risk Management Techniques for Different Types of Trading

Regardless of the types of trading you follow, using effective risk management strategies helps limit losses and maximize profits:

- Position Sizing: Adjust the size of your trades based on your risk tolerance; ideally, limit exposure to 1–2% of your total capital.

- Use Stop-Loss Orders: Automatically exit trades when prices move against you beyond a set level to avoid heavy losses.

- Diversify Investments Spread your trades across various stocks or markets to minimize risk from overexposure.

- Evaluate Risk-Reward Ratios: Aim for a 2:1 ratio, where potential profit is double the possible loss.

- Conduct Risk Assessments: Analyze potential risks before trading and choose strategies that match your comfort level.

By applying these principles, traders can manage risks effectively while making the most of opportunities across different types of trading in stock market.

Final Words

Each types of trading strategies, whether it’s intraday, swing, fundamentals based or positional, has its own pros & cons. Beginners should start with understanding their risk tolerance and time commitment before choosing a strategy. If you’re just starting out, consider paper trading to test your strategy. And remember, no matter the style, risk management is key.

FAQs on Types of Trading in Stock Market

How many types of trading are there?

There are different types of trading in India include intraday trading, delivery trading, derivatives trading, swing trading, and positional trading, offering various strategies to suit different investor goals.

What are the types of intraday trading?

Types of intraday trading include scalping, momentum trading, breakout trading, and reversal trading. These strategies help traders capitalize on price movements within a single trading session effectively.

What is the difference between intraday and swing trading?

Intraday trading involves buying and selling on the same day, while swing trading holds positions for a few days to capture short term price movements.

Is short selling allowed in the Indian stock market?

Yes, short selling is allowed in the Indian market for intraday trades. In futures, you can hold short positions beyond a day.

Which type of trading is best for beginners?

Swing trading is suitable for beginners as it allows more time for analysis and decisions, compared to the fast nature of intraday trading or scalping.

What tools do traders use for technical analysis?

Traders use charting platforms like TradingView, Chartink and broker terminals to analyze price patterns, moving averages, volume and momentum indicators.

Is scalping profitable for retail traders?

Scalping can be profitable but requires speed, precision and experience. It's risky for beginners due to frequent trades and thin profit margins.

Happy investing and thank you for reading!

Disclaimer:

This website content is only for educational purposes, not investment advice. Before making any investment, it’s important to do your own research and be fully informed. Investing in the stock market includes risks, and you should carefully read the Risk Disclosure documents before proceeding. Please remember that past performance doesn’t guarantee future results, and due to market fluctuations, your investment goals may not always be achieved.

Share via:

- By Hemant Bisht

- 3