Subscribe for real-time financial insights on Trade Target’s WhatsApp Channels

The Medi Assist Healthcare IPO is set at Rs 1,171.58 crores, representing a book-built issue. Notably, the entire issue consists of an offer for sale of 2.8 crore shares. Investors can subscribe to the IPO starting January 15, 2024, with the subscription window closing on January 17, 2024.

If you’re considering investing in this IPO, these objectives suggest potential benefits in terms of increased market exposure and liquidity for shareholders.

The primary aim of the Medi Assist Healthcare IPO is to gain the advantages of being listed on stock exchanges. By going public, the company anticipates an increase in visibility and brand recognition. This step is also expected to offer liquidity to existing shareholders. Importantly, the IPO provides a public market for the company’s equity shares in India.

Medi Assist Healthcare IPO Details

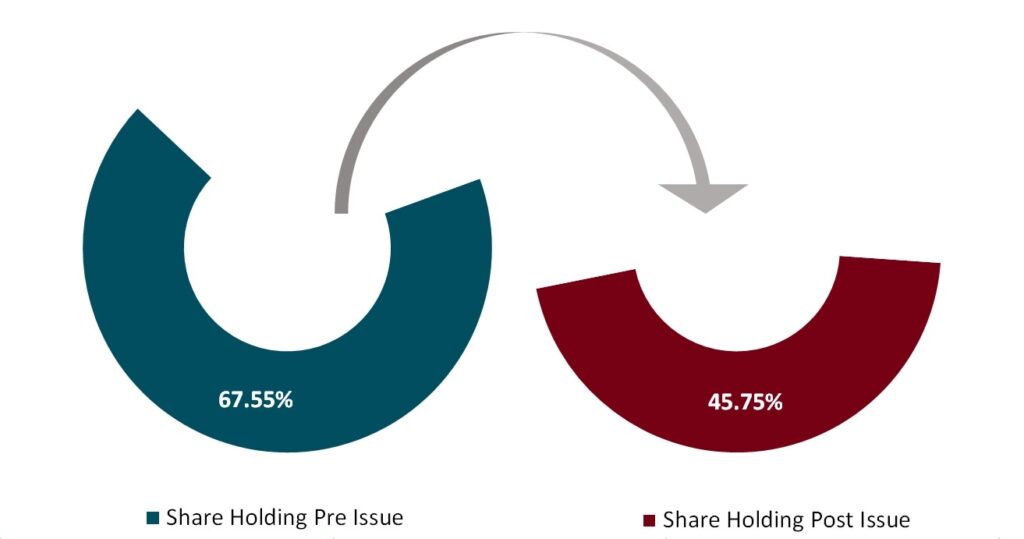

Medi Assist Healthcare IPO Promoter Holding

Investing in the Medi Assist Healthcare IPO could be appealing to those seeking a stake in a growing healthcare company.

Before the IPO (Initial Public Offering), the people who founded Medi Assist Healthcare, including Dr. Vikram Jit Singh Chhatwal, the company Medimatter Health Management Private Limited, and Bessemer India Capital Holding II Ltd., owned about 67.55% of the shares. After the IPO, their ownership will reduce to 45.75%.

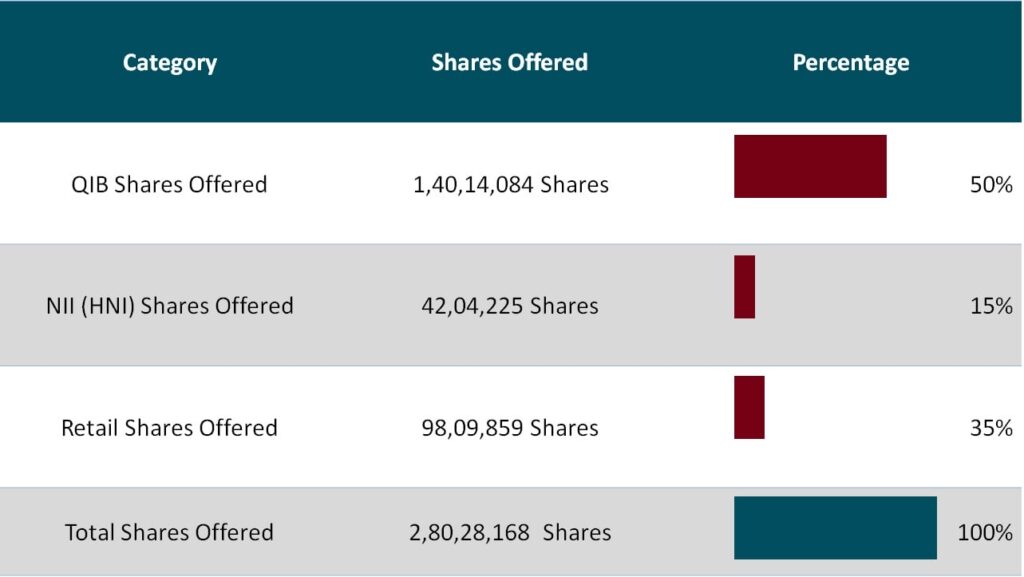

Medi Assist Healthcare IPO Reservation

If you’re considering investing in the Medi Assist Healthcare IPO, it’s important to note the distribution of shares among different investor categories.

Out of the total shares offered, 50% are allocated for Qualified Institutional Buyers (QIB), 15% for Non-Institutional Investors (NII), and the remaining 35% for Retail Investors. The total number of shares offered in the IPO is 2,80,28,168.

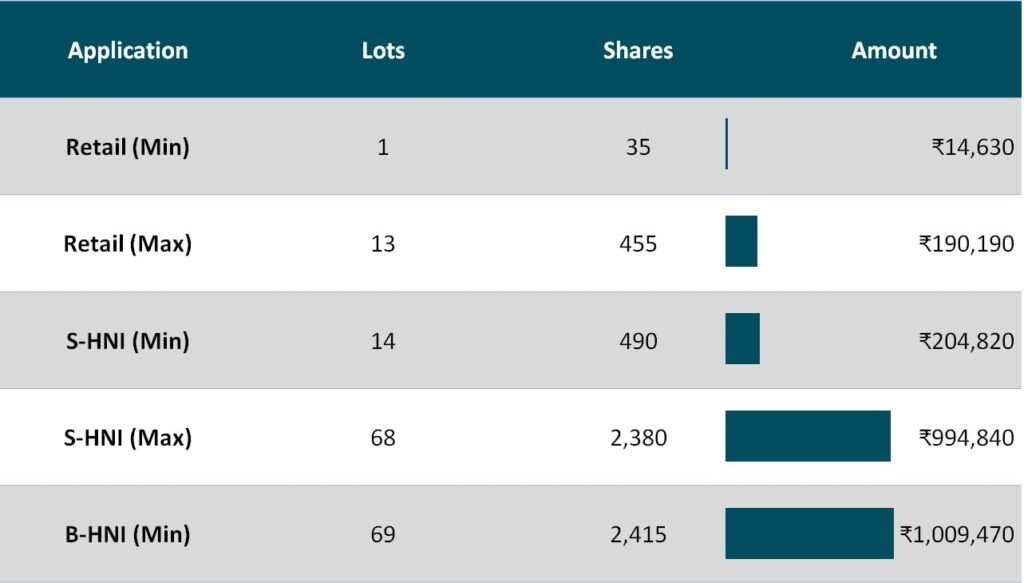

Medi Assist Healthcare IPO Lot Size

If you’re considering investing in this IPO, these lot sizes provide flexibility and accessibility, catering to both retail and high-net-worth individuals. The Medi Assist Healthcare IPO offers investors an opportunity to participate in the stock market with a minimum bid of 35 shares and multiples thereof.

- Retail investors can apply for 1 to 13 lots, translating to 35 to 455 shares, with corresponding amounts ranging from ₹14,630 to ₹190,190.

- Similarly, Small High Net Worth Individuals (S-HNI) and Big High Net Worth Individuals (B-HNI) can bid for 14 to 68 lots and 69 lots onwards, respectively, with varying share quantities and investment amounts.

Medi Assist Healthcare IPO Dates (Tentative Timeline)

The stock is set to make its debut on January 22, 2024, making it an interesting prospect for those looking to participate in the healthcare sector’s growth.

The below timeline provides a clear roadmap for potential investors to plan their involvement in the Medi Assist Healthcare IPO, ensuring investors don’t miss out on this investment opportunity.

About Medi Assist Healthcare

Founded in June 2002, Medi Assist is a health-tech and insurance-tech company based in India. The company specializes in managing health benefits for employers, retail members, and public health schemes. Its services primarily cater to insurance companies, functioning as a mediator in various key relationships.

Services:

Medi Assist provides a range of services, including medical insurance and facilitating cashless hospitalization. The company operates through a vast network of healthcare service providers, collaborating with 36 insurance companies both in India and globally.

Healthcare Network:

As of March 31, 2023, Medi Assist has established an extensive healthcare network across India. This network comprises over 14,000 hospitals spread across 967 cities and towns in 32 states and union territories.

Achievements in FY 2023:

During the financial year 2023, Medi Assist achieved significant milestones. They settled a total of 5.27 million claims, which included 2.44 million in-patient claims and 2.83 million out-patient claims.

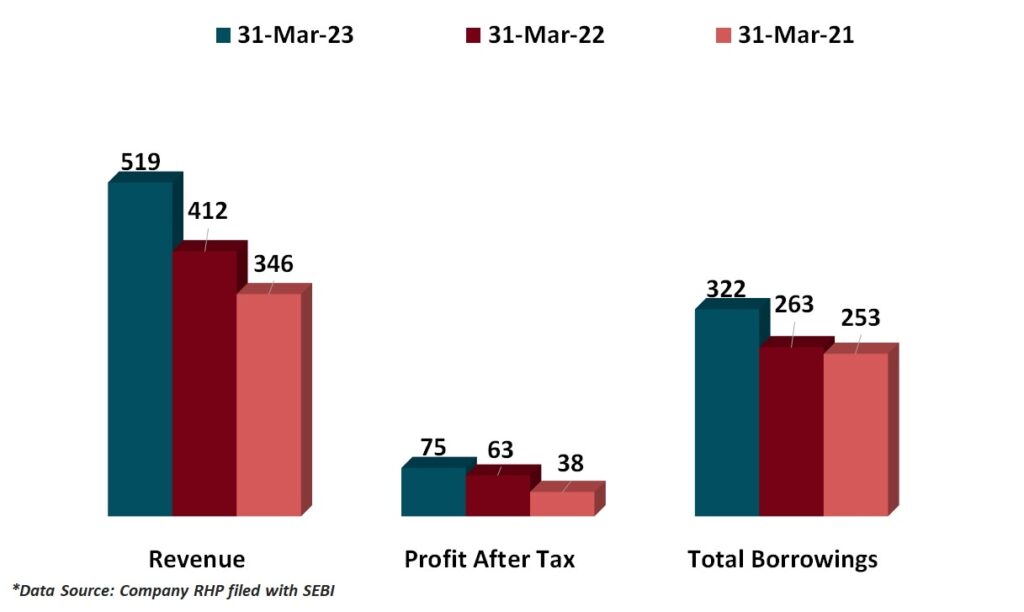

Medi Assist Healthcare Financials (Amount in ₹ Crores)

Understanding the financials of a company like Medi Assist Healthcare is crucial for investors looking to make informed decisions. Analyzing key financial indicators, such as revenue, profit after tax, and total borrowings, provides insights into the company’s financial health and performance over time.

- In the financial year ending on March 31, 2023, Medi Assist Healthcare reported a revenue of ₹519 crores, marking an increase compared to ₹412 crores and ₹346 crores in the preceding two years.

- The profit after tax also demonstrated positive growth, reaching ₹75 crores in the latest fiscal year, up from ₹63 crores and ₹38 crores in the previous periods.

- Concurrently, total borrowings stood at ₹322 crores, ₹263 crores, and ₹253 crores for the respective years.

The below financial indicators suggest a positive shift in the company’s financial health for potential investors eyeing the Medi Assist Healthcare IPO.

- The company's assets have grown from ₹602.23 crores in 2022 to ₹705.72 crores in 2023, indicating a healthy expansion.

- The net worth has also increased from ₹339.29 crores to ₹383.67 crores, reflecting a solid financial foundation.

- Reserves and surplus show a consistent upward trajectory, reaching ₹353.86 crores in 2023.

- Return on equity stands at 19.30%, signaling profitability and efficient use of shareholder funds.

- Return on assets, a key indicator of operational efficiency, is also favorable at 10.49%.

- The earnings per share has risen from ₹3.88 to ₹10.65, demonstrating the company's ability to generate value for its investor.

Share via: